- What Does Valuation Mean in Finance?

- Reasons for Performing a Valuation

- 1. Buying or selling a business

- 2. Strategic planning

- 3. Capital financing

- 4. Securities investing

- 5. Tax Purposes and Financial Reporting

- Key Valuation Methodologies Explained

- Method 1: Discounted Cash Flow (DCF) Analysis

- Method 2: Comparable Company Analysis (“Comps”)

- Method 3: Precedent Transactions

- Understanding the Valuation Process

- Additional Valuation Methods

- Frequently Asked Questions About Valuation

What is Valuation in Finance? Methods to Value a Company

Learn how finance professionals determine the value of a company or asset using structured, proven valuation methods.

What Does Valuation Mean in Finance?

In finance, valuation refers to the process of assessing the worth of a company, investment, or asset based on future cash flows, financial statements, and other key indicators. While the stock market reflects current trading prices, valuation focuses on intrinsic value — what something is truly worth based on fundamentals.

Valuation plays a central role in corporate finance, investing, and strategic decision-making. Professionals use various methods to determine whether an asset or business is overvalued or undervalued.

Key Highlights

- Valuation is the process of determining the theoretically correct value of a company, investment, or asset, as opposed to its cost or current market value.

- Common reasons for performing a valuation are for M&A, strategic planning, capital financing, and investing in securities.

- The most widely used business valuation methods are discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions.

Reasons for Performing a Valuation

There are many valuation methods, but they all serve the purpose of supporting better business and financial decisions. Common reasons for conducting a valuation include:

1. Buying or selling a business

Buyers and sellers use business valuation to determine a fair transaction price. It ensures both parties align on value based on the company’s financial standing and future outlook.

2. Strategic planning

A company should only invest in projects that increase its net present value. Companies evaluate potential investments, acquisitions, or expansion strategies by estimating future growth and expected returns. This makes any investment decision essentially a mini-valuation based on the likelihood of future profitability and value creation.

3. Capital financing

Lenders and investors use valuation to assess a company’s ability to generate future cash flows and service its debt. A credible financial valuation supports funding discussions.

4. Securities investing

Valuation plays a key role in determining whether a stock or bond is priced appropriately compared to its intrinsic value and comparable assets.

5. Tax Purposes and Financial Reporting

Fair value calculations are required for regulatory compliance, estate planning, and financial reporting.

Key Valuation Methodologies Explained

Valuing a company depends on the context, whether it’s for investment, M&A, or internal planning. The three most widely used company valuation methodologies are:

(1) DCF analysis;

(2) Comparable company analysis; and

(3) Precedent transactions.

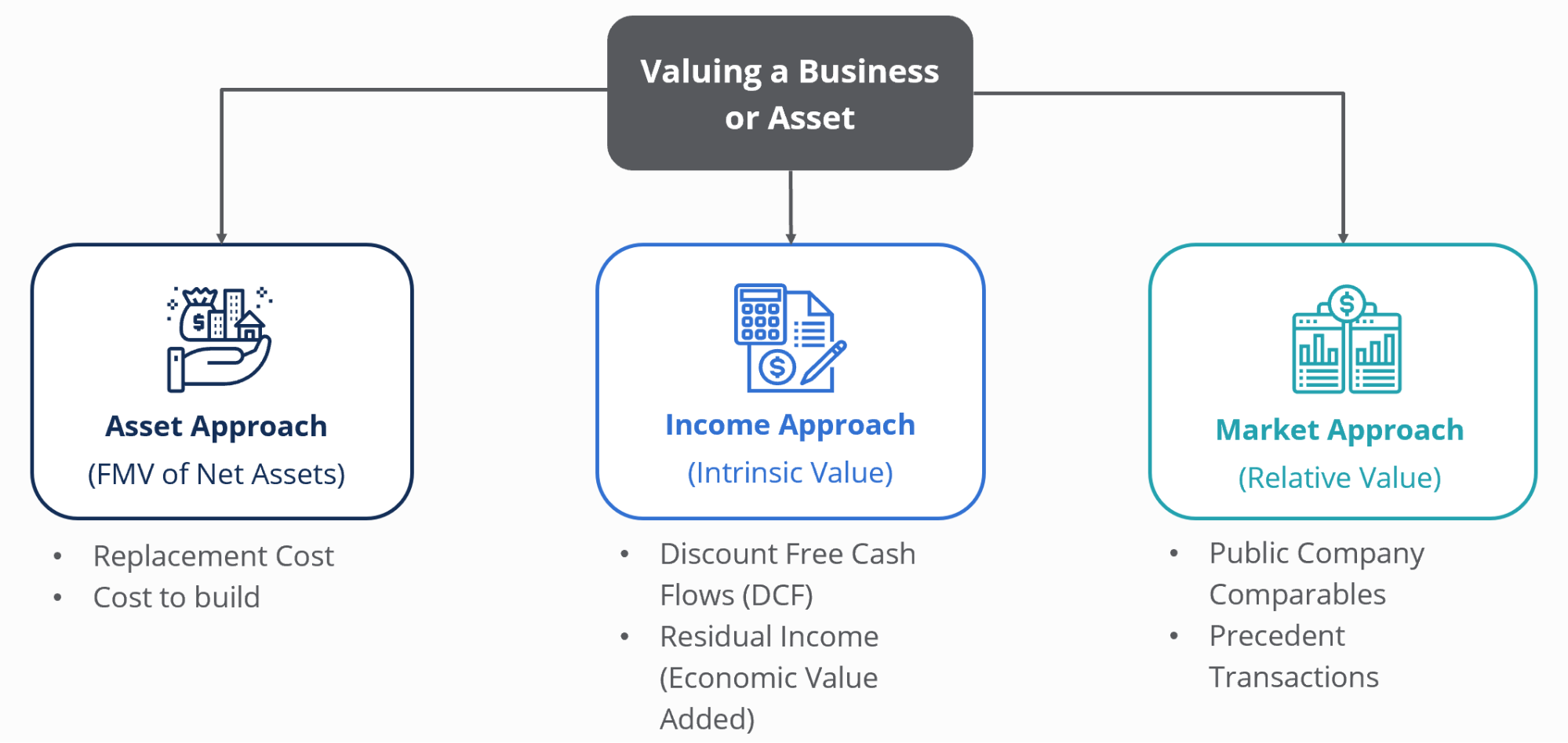

As shown in the diagram below, when valuing a business or asset, there are three different approaches one can use. These include the asset approach, the income approach, and the market approach:

- The asset approach calculates the fair market value of individual assets, often using replacement cost or cost to build. It’s commonly applied when valuing real estate or asset-heavy businesses.

- The income approach, with discounted cash flow (DCF) being the most widely used, determines intrinsic value based on projected future cash flows.

- The market approach is a form of relative valuation that compares the business to similar companies or past transactions in the same industry.

Method 1: Discounted Cash Flow (DCF) Analysis

Discounted cash flow (DCF) analysis is an intrinsic valuation method. It involves forecasting a company’s unlevered free cash flows and discounting them to present value using the firm’s weighted average cost of capital (WACC). The result estimates the company’s intrinsic value.

- Best suited for companies with stable, predictable cash flows.

- Allows for scenario planning and sensitivity analysis.

- Common in equity research, M&A, and financial modeling.

DCF, also known as discounted cash flow valuation, is one of the most detailed approaches to assessing a company’s future performance.

Method 2: Comparable Company Analysis (“Comps”)

Comparable company analysis (also called “trading comps”) is a relative valuation method in which you compare the market valuations of similar companies—often referred to as peer companies—to estimate value. Analysts compare multiples like EV/EBITDA or P/E ratios to determine what a business should be worth based on market data.

- Relies on publicly available information.

- Reflects how similar companies are valued today.

- Common in investment banking and corporate development.

Comps are effective when similar companies exist and data is accessible, making it one of the most practical business valuation methods.

Method 3: Precedent Transactions

Precedent transactions analysis is another form of relative valuation where you evaluate the prices paid in recent M&A deals involving similar businesses. These transactions include control premiums and reflect real-world acquisition prices.

- Most useful in M&A advisory and strategic acquisitions.

- Captures buyer behavior and competitive dynamics.

- Should be updated regularly to remain relevant.

Transaction data can provide insight into a company’s fair value in the context of a sale or acquisition.

Understanding the Valuation Process

Analysts often summarize valuation outcomes using a football field chart, which visually compares value ranges across methods such as DCF, comparable analysis, and precedent transactions. Below is an example of a football field graph, which is typically included in an investment banking pitch book.

A football field chart presents a side-by-side comparison of valuation results from different methodologies. It shows the range of values for a company or asset derived from:

- Discounted Cash Flow (DCF) analysis

- Comparable company analysis

- Precedent transactions

- Analyst target prices

- Market trading range

The chart helps summarize valuation perspectives in a single visual format, often used in investment banking pitch books and strategic presentations to support decision-making.

As you can see, the graph summarizes the company’s 52-week trading range (it’s stock price, assuming it’s public), the range of prices equity research analysts have for the stock, the range of values from comparable valuation modeling, the range from precedent transaction analysis, and finally the DCF valuation method. The orange dotted line in the middle represents the average valuation from all the methods.

Additional Valuation Methods

In addition to the primary approaches, analysts may use several other techniques, including:

- Asset-Based Valuation Method: Values the company based on the fair market value of tangible assets and liabilities. Often used when valuing capital-intensive businesses or for liquidation scenarios.

- Contingent Claim Valuation: Applies option pricing models when a company’s future outcomes are highly uncertain.

- Liquidation Value: Estimates value based on selling off assets individually.

- Ability-to-Pay Analysis: Determines the highest price an acquirer can offer while meeting return targets.

Many valuation methods may be used together depending on the situation, industry, and availability of data.

Frequently Asked Questions About Valuation

What is a valuation?

A valuation is an estimate of what a business, asset, or investment is worth based on future performance and current financial data.

What are valuations used for?

They are used to support investment, lending, M&A, strategic planning, and tax or legal requirements.

What is valuation in finance?

It’s a process used by professionals to estimate economic value and inform decisions about investments and business strategy.

How do you value a company?

Common approaches include DCF, comparable company analysis, and asset-based valuation methods, each suited to different business types and contexts.

What does valuation mean in a business context?

It means applying structured analysis to determine fair value, whether for funding, M&A, internal planning, or compliance.